.jpg)

FinTalkr AI for Enterprise

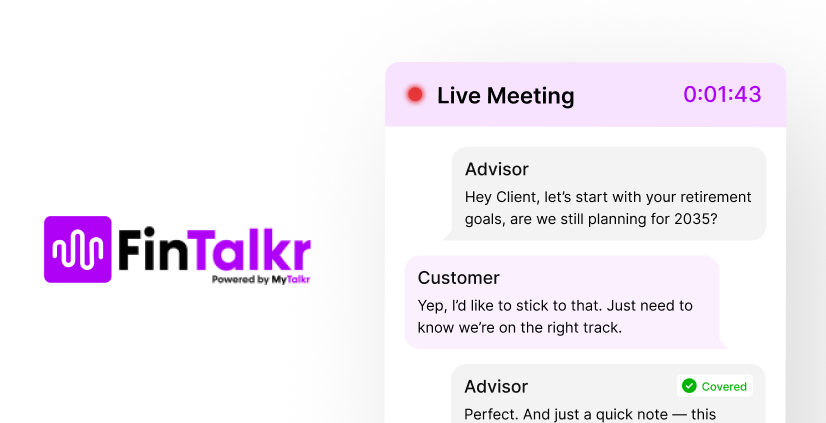

FinTalkr Enterprise Edition supercharges productivity across financial institutions — from advisory and accounting to mortgage and insurance. Powered by advanced, Australian-hosted AI, it automates entire workflows end-to-end using Agentic AI, seamlessly integrating humans and AI agents to transform how work gets done. With enterprise-grade security, full data sovereignty, and regulatory-aligned record-keeping, FinTalkr reduces compliance risk, strengthens governance, and elevates both client and operational outcomes.

While MIT reports that 95% of generative AI projects fail, FinTalkr Enterprise Edition is proven to deliver. Delivery is through market leading AI expertise, cutting-edge AI and deep financial-services expertise. FinTalkr’s specialists work directly with enterprise teams to tailor integrations and workflows that drive measurable productivity, efficiency, and compliance from day one — helping firms operationalise AI safely, effectively, and at scale.

AI Implemented

Projects Delivered

Productivity Up

Costs Down

AI Expertise Engaged

Risks Mitigated

Regulator Comfort

Board Comfort

Why Enterprises Choose FinTalkr

Deep AI Expertise

The FinTalkr team deliver AI projects on time and budget. Contact us to speak to some of our enterprise clients

Book a Demo

Enterprise Platform

Platform adopted by the largest financial firms in the county, provenm in enterprise environments

Book a Demo

Enterprise Grade Features

We’ve architected FinTalkr with compliance-first principles, including:

End to end workflows & processes are automated leveraging AI

Full traceability – data, ai agent activity, human interventions, explainability to compliance and regulators

Input documents, voice (real time), chats and other inputs

Generate complex documents, application forms, compliance reports and more to meet your enterprise standards

Human intervention, notification and QA checks at key process checkpoints

Enterprise monitoring of AI workflows with real-time dashboards, notifications and reporting

Enterprise security - triple encrypt all data

Run in our cloud or yours

API integration to your ecosystem

Custom Solutions for Enterprise Clients

Every enterprise is different. That’s why we offer:

Custom Solutions for Enterprise Clients

Unlimited user seats for scalable collaboration

Dedicated account management and white-glove support

Training & onboarding for rapid implementation

See It In Action

“With FinTalkr, we’ve reduced meeting documentation time by over 50% and improved compliance visibility across our advisory network.”

— CIO, Tier-2 Wealth Management Firm

.jpg)

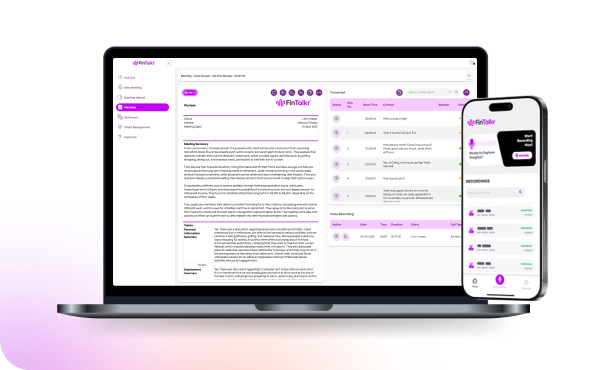

Built for Regulated Environments

We’ve architected FinTalkr with compliance-first principles, including:

SOC 2 Certification (in progress)

ASIC & AFSL aligned recordkeeping

Encrypted data storage and access control

No data sharing with third parties

Case Study: Scaling Advice with Enterprise AI

A Large Wealth Company rolled out FinTalkr to 240 users over a 10-week program. File notes templates were customised to meet the firms standards and then standardised nationally. FinTalkr was integrated into the firms downstream systems including Xplan. Group views enabled Advisers in each branch to view and edit file notes and documents within their branch. Advise standards were implemented nationally. FinTalkr worked with the firm daily to achieve an outstanding result in record time.

Get Started

Transformation Across the Advice Process

FinTalkr is partnering with the Wealth Company to revolutionise the Wealth Process with AI:

Client meetings – structured capture and AI-assisted summarisation.

Documentation – automatic, compliant record-keeping.

Paraplanning – efficient handover, tracking, and completion.

Advice generation – work with us on creation of ROA's and SOA's

Client engagement – consistent, timely communication

Outcomes

- Supercharged advice efficiency and speed, slash costs & reduce risk.

- Established a single enterprise AI platform to unify advice processes.

- Centralised data for safety, compliance, and country domicile.

- Converged toward company standards, reducing variability & improving defensibility.

- Enterprise platform with full governance, control and transparency over how AI is applied to a client account

- Data insights across client base and Advisers. eg Product demand, cross-sell, opportunities, risk events

- Integration to other systems for end to end process efficiency and risk management.

Previously

The Wealth Company had tried POCs, custom building and deploying co-pilot to individuals:

- Developed a proof of concept that ran against a test call

-

Transitioning from POC to enterprise grade platform was very challenging

- Accomodating real wrold meeting environments with background noise, internet connectivity issues, different accents

-

Building, running operating, supporting a platform of this scale became expensive and hight risk

-

Using co-pilot at an individual level created a huge variation in human input, prompts and outputs.

- Ultimately they realised they were a wealth company, not an AI tech firm.

After 18 months of POC, they opted for FinTalkr with a 10 week roll-out.